Note:If married filing separately, check "Married, but withhold at higher Single rate."

5 Total number of allowances you’re claiming (from the applicable worksheet on the following pages).

6 Additional amount, if any, you want withheld from each paycheck.

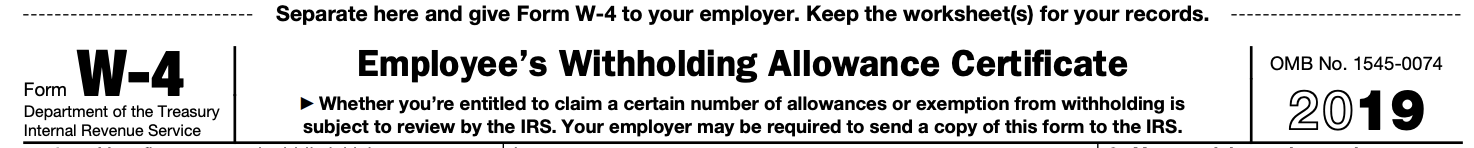

7 I claim exemption from withholding for 2019, and I certify that I meet both of the following conditions for exemption.

If you have Pre-Tax deductions withheld from your paycheck, please enter in the per pay period amount withheld below; otherwise, leave it at zero (0).

How much do you earn per paycheck?

You must enter in a value greater than zero (0) above to continue!

How often are you paid?

The total pay period estimated Federal Income Taxes will be:

**The above number is an estimation and should only be used as a reference point. Questions regarding the amounts you are paid, deducted, or taxed should all be brought to your employer for further clarification. Workforce 2080 provides these estimations to assist employees and employers determine a rough estimation of what taxes, payments, or deductions *could* be. These estimations should not be construed as implict or explicit guarantees in any way. Many factors come into play, such as rounding of figures in Payroll Software, errors in the submission through this portal etc. Workforce 2080 assumes no risk with these estimations and provides these tools to help educate the general population. All users who use these products and estimators outside of their intended use assume risk when used outside of the scope of educational and general knowledge.